Top Insurance Agent App Considerations for Efficiency

Updated on

Updated on

By Ringy

Table of Contents

Table of Contents

Insurance agents know better than anyone that staying organized and efficient is key to building lasting client relationships and closing deals. But between juggling policy details, client appointments, and endless follow-ups, it can be easy to feel like a personal assistant to yourself!

Thankfully, modern technology—and a solid mobile app—can help turn those daily hassles into a streamlined process that's not only more productive but also accessible from anywhere.

In this guide, we'll look at the top considerations when choosing an insurance agent app that helps to simplify the customer journey and boost your efficiency.

From managing leads with tools like Ringy CRM to accessing real-time data, we'll cover the best apps out there for life, health, and independent insurance agents alike.

After all, whether you're in a meeting or waiting on the sidelines of a soccer game, an effective mobile app can be the ace up your sleeve, keeping your workflow as smooth as possible.

Essential Features to Look for in an Insurance Agent App

So, you're ready to level up your insurance game with a mobile app? Awesome! But with so many options out there, how do you know which one's the right fit? Let's break down the essential features to look for in an insurance agent app.

1. Lead Management

Effective lead management is critical in any sales-driven profession, and for insurance agents, it's a lifesaver. An app with lead management tools helps you categorize and prioritize leads, so follow-ups are easy and consistent. Here's what to look for:

- Lead Capture Tools: Save new leads directly to your app through forms or integrations with social media and email.

- Lead Scoring: Prioritize leads based on their potential value to your business.

- Lead Assignment: Assign leads to specific agents or teams to ensure timely follow-up.

- Customizable Workflows: Create personalized follow-up sequences to nurture leads and move them through the sales pipeline. For instance, Ringy offers lead management features that enable agents to track progress with each prospect, ensuring no lead slips through the cracks.

- Follow-Up Reminders: Take every chance to engage with leads at just the right moment.

2. Prospect Research Database

Having access to a robust prospect research database can significantly improve your targeting strategy. By pulling in key data on prospects, you can tailor your approach to address their specific needs and interests. Features that support better research include:

- Real-Time Data Access: Keep up-to-date with changes in client or prospect details.

- Data Segmentation: Filter prospects by location, policy type, or life stage to help you hone in on your ideal clients.

These research tools can turn cold leads warm, giving you an edge in personalization—because nobody wants to be the agent who doesn't know the first thing about their prospect.

3. CRM Capabilities

Built-in CRM capabilities allow agents to manage every client relationship in one place, seamlessly integrated into their daily routine. A CRM system lets you store interaction histories, track client preferences, and manage notes that can be quickly referenced on the go. Here's why this feature is a must:

|

Features |

Description |

|

Interaction Tracking |

A quick scroll through past interactions can reveal valuable context for your next call. |

|

Centralized Notes |

Forgetting important details can make you appear less invested—CRM notes keep those small but meaningful details front and center. |

|

Calendar Integration |

Schedule appointments set reminders, and track deadlines. |

|

Document Storage |

Securely store important documents, such as policies, contracts, and client files. |

With features designed specifically for insurance agents, Ringy helps you keep track of each client touchpoint, so every conversation feels like picking up right where you left off.

4. Document Management and e-Signatures

Document management with e-signature capability is a huge asset. Sending, storing, and signing documents digitally not only cuts down on paperwork but also speeds up the sales process, keeping clients engaged. Look for:

- Secure Storage: Keep sensitive documents organized and accessible only to those with permissions.

- Digital Signing: Clients can review and sign policies instantly, eliminating the delay of in-person meetings or mailed paperwork.

- Version Control: Stay on top of policy updates by keeping the latest versions accessible at a tap.

5. Quote Calculators

The days of pen and paper price estimates are over. Quote calculators make it easy to provide accurate pricing estimates on the spot, a major advantage in sales discussions:

- Instant Quotes: Impress clients by calculating policy costs during meetings.

- Customizable Fields: Adjust parameters to suit specific client needs, from coverage levels to premium amounts.

- Client Comparison Tools: Some apps even allow for side-by-side comparisons to show clients how different policies stack up.

6. Policy Management

A top insurance agent app should make policy management a breeze. With tools to view, update, and even renew policies on the go, agents can ensure clients' needs are met with minimal delays.

Therefore, look for an insurance agent app that can accomplish the following:

- Policy Overview: Review active policies, upcoming renewals, and key coverage details in seconds.

- Automated Alerts: Receive reminders for policy renewal dates or any client-specific updates.

- Client Self-Service Options: Some apps allow clients to view certain aspects of their policy themselves, freeing up your time for more strategic tasks.

These features collectively offer a comprehensive toolkit for insurance agents, helping them manage client needs while enhancing the customer journey.

These app capabilities are essential for onboarding new clients, following up with prospects, and renewing policies, making the process easier.

Best Apps for Insurance Agents by Category

Now that we've covered the essential features, let's look at some of the best apps for insurance agents. We'll categorize them based on their specific strengths and target audience.

1. All-Purpose Insurance Apps

For agents who need a comprehensive toolkit, all-purpose insurance software apps bring together essential features like client management, quotes, and documentation into one seamless experience. These apps make it easy to handle various aspects of client interactions in a single interface.

- Example: Ringy CRM

We know it might seem biased, but hear us out. Ringy is a comprehensive CRM tool designed specifically for insurance agents. Ringy offers features like lead management, contact management, document storage, and more. It's a great option for agents who want to streamline their workflows and improve productivity.

2. Mobile Apps for Life Insurance Agents

Life insurance agents need tools focused on policy details and calculators that can quickly assess premiums based on client data. These apps should streamline the unique requirements of life insurance, helping agents offer accurate information and options on the spot.

- Example: Life Happens Pro

Life Happens Pro is designed specifically for life insurance agents. It includes a life insurance needs calculator, customizable marketing tools, and even educational resources to help you engage clients effectively. The app is ideal for on-the-go quoting, giving agents a reliable resource to calculate and present premiums in seconds.

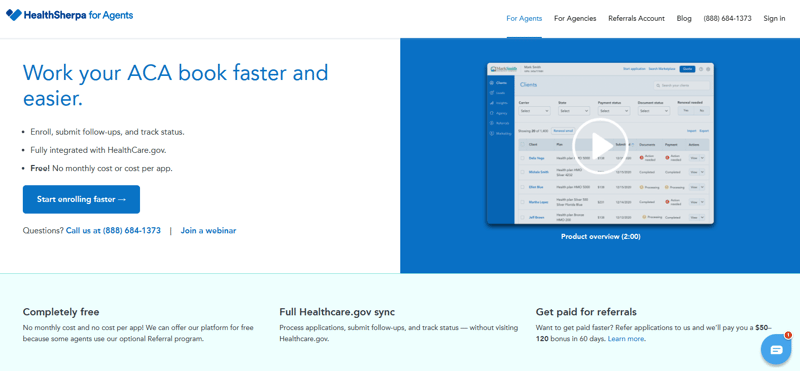

3. Mobile Apps for Health Insurance Agents

When it comes to health insurance, agents often need specific tools to compare plans, check eligibility, and provide clients with accurate coverage information. Health insurance apps simplify these tasks by centralizing relevant data and making plan comparisons more manageable.

- Example: HealthSherpa

HealthSherpa is a great choice for health insurance agents, offering a platform to compare health plans, check client eligibility, and complete enrollments. It's integrated with the healthcare marketplace, allowing agents to pull in accurate and updated plan details so that clients can see side-by-side comparisons.

Plus, HealthSherpa's mobile access makes it easy for agents to handle client needs from any location.

4. Mobile Apps for Independent Insurance Agents

Independent insurance agents often handle multiple lines of business and need an app that's flexible enough to support this diverse workload. Apps for independent agents should cater to everything from client management to multi-policy handling.

- Example: EZLynx

EZLynx is a popular app among independent insurance agents. It combines features for managing various policy types, from auto to life insurance, allowing agents to handle multiple products from one platform. EZLynx also includes a built-in CRM, lead tracking, and policy comparisons, making it an ideal tool for independent agents who need comprehensive, multi-line support.

5. Best Prospecting and Lead Generation Apps

In any sales-driven role, prospecting and lead generation are the bread and butter of your work. These apps are tailored to help agents find and manage leads, offering tools like prospect research databases, lead tracking, and CRM integrations to simplify the hunt for potential clients.

- Example: Ringy CRM (again!)

Ringy CRM is a standout in this category, providing tools for lead tracking, automated follow-ups, and a prospect research database. Ringy's mobile accessibility ensures that you can nurture leads from anywhere, helping you convert more prospects into clients without missing a beat.

Our CRM features are designed with the insurance industry in mind, making Ringy an efficient tool for agents focused on relationship-building.

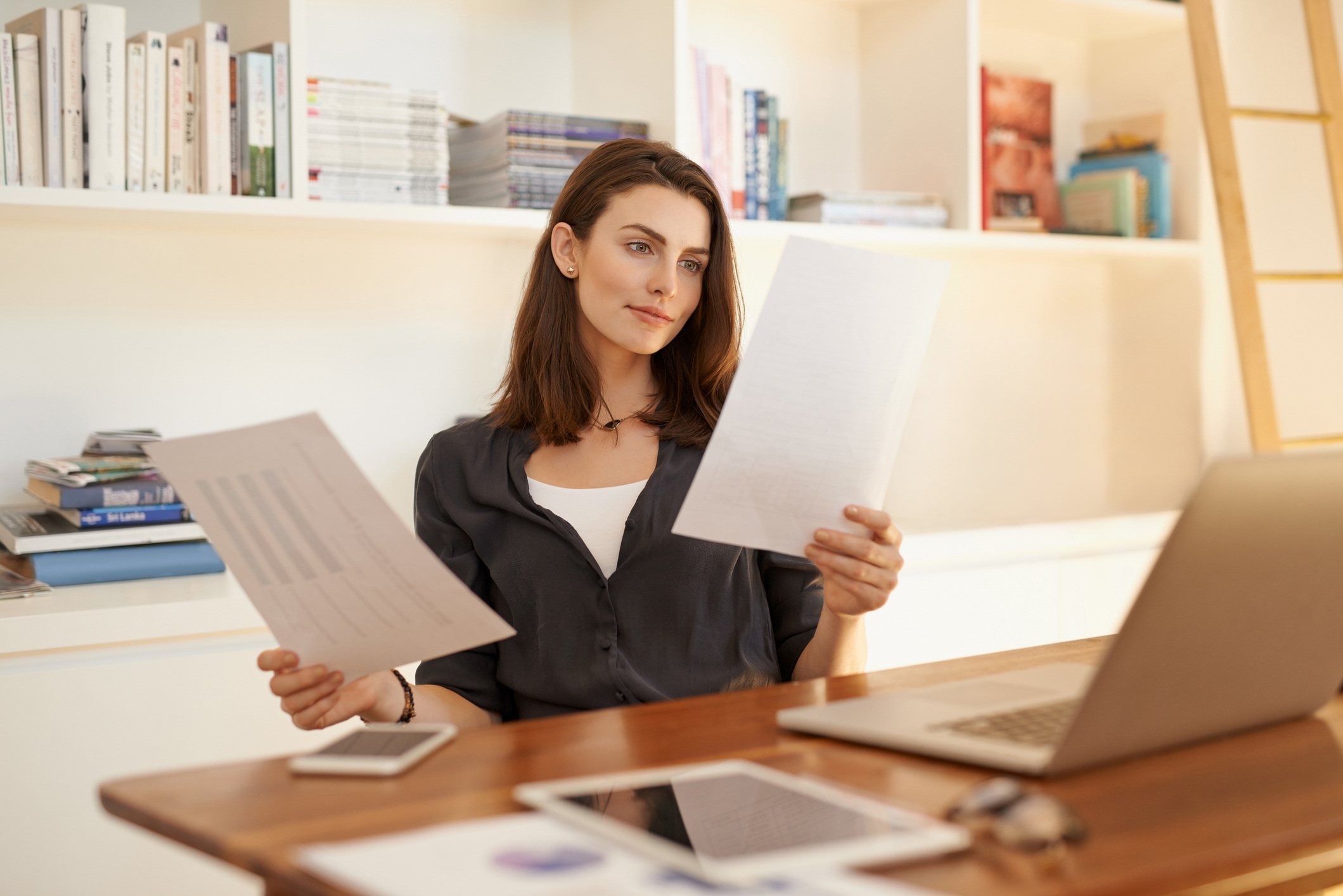

How to Choose the Best Insurance Agent App for Your Needs

Choosing the right app is about more than finding one with fancy features; it's about matching a tool with the unique demands of your insurance business.

Here's a breakdown of what to consider to make the best choice.

Assess Your Requirements

Different types of insurance require different tools, and choosing an app that caters to your niche can make a huge difference in your daily operations.

- For Life Insurance Agents: Look for apps with calculators for assessing coverage and tools for managing policy details. Apps tailored to life insurance often include educational resources and customizable tools for engaging clients.

- For Health Insurance Agents: Health insurance apps should prioritize features like plan comparison tools and eligibility checkers to help clients choose plans based on their unique needs.

- For Independent Agents: If you're handling multiple types of insurance, you'll need an app with versatile CRM capabilities and cross-policy management. Apps that integrate lead tracking and prospect research databases can help you stay organized while managing diverse policy offerings.

Taking a step back to assess these requirements can prevent investing in a tool that feels impressive but doesn't address the specific needs of your line of insurance.

Consider Integration Capabilities

An app that doesn't sync with your current CRM, quoting software, or policy management systems can end up adding more hassle than it saves. Make sure the app you choose can integrate seamlessly with your existing tools.

- CRM Integration: CRMs are essential in the insurance industry, and apps with CRM features are often a valuable choice. But if your CRM, like Ringy, already provides robust contact and lead management, look for apps that connect with it rather than duplicating efforts.

- Policy Management Systems: Many agents rely on specific systems for policy management. Apps that sync directly with these systems reduce redundant data entry and ensure you're always working with up-to-date client and policy information.

Not only does integration make things smoother, but it also ensures your customer journey flows seamlessly from one platform to another.

User-Friendliness

Ease of use is one of the most critical factors in app adoption. If an app is difficult to use, even the best features become irrelevant because they're hard to access or time-consuming to learn.

For use-friendliness, consider the following factors:

- Intuitive Interface: Look for a user interface that doesn't require constant toggling between screens or intense onboarding time. Insurance agents often juggle multiple tasks, so an intuitive app saves time and keeps processes efficient.

- Customer Support: An app with accessible customer support is always a bonus. Even with user-friendly tools, occasional troubleshooting is inevitable, and good support can make a big difference in how smoothly you can integrate the app into your workflow.

The easier it is to use, the quicker you can focus on what truly matters—building relationships with clients and securing policies.

Cost and ROI

Lastly, consider the cost versus the return on investment. While it's easy to be enticed by free or budget-friendly apps, investing in a slightly more expensive option could pay off significantly in time saved and increased sales. Here's how:

- Upfront Cost and Subscription Plans: Look at whether the app has a one-time fee or if it's subscription-based. Some apps offer free versions with basic features, while premium plans unlock advanced tools. Compare these options based on your budget and how much value the additional features would bring.

- Evaluating ROI: Consider how the app's features might directly improve your workflow and client management. For example, an app with lead management and CRM capabilities can boost your follow-up process, which can lead to higher conversion rates. A quick calculation of time saved and productivity gained can show whether the app's price tag is worth the investment.

An app with a higher upfront cost might save you from paying for multiple tools that provide overlapping functions. In the end, a well-chosen insurance agent app not only makes day-to-day work easier but also provides the tools for better client interactions and, ultimately, higher sales.

Conclusion

Choosing the best app for insurance agents is about matching the app's capabilities with your unique needs as an insurance professional.

From lead management and CRM integration to policy management and cost-effectiveness, each feature you prioritize can directly impact how smoothly and effectively you manage client relationships, boost productivity, and increase sales.

That said, we encourage you to consider our insurance CRM, Ringy—a comprehensive CRM that's built for insurance agents looking to optimize their workflow.

With intuitive lead management, in-depth CRM features, and seamless integration options, Ringy is an insurance agent app that ensures you can manage all aspects of the customer journey effortlessly. Whether you're reaching out to prospects, following up with clients, or organizing policy details, Ringy's tools are designed to make your job easier.

Try Ringy today to see how a dedicated CRM can transform your workday and elevate your client experience.

Skyrocket your sales with the CRM that does it all.

Calling? Check. SMS? Check. Automation and AI? Check. Effortlessly keep in touch with your customers and boost your revenue without limits.

Take your sales to new heights with Ringy.

Sales in a slump? Ringy gives you the tools and flexibility you need to capture leads, engage with them, and turn them into customers.

Subscribe to Our Blog

Enter your email to get the latest updates sent straight to your inbox!

Categories

Related Articles