The Pros and Cons of Free Insurance Agency Management Software

Updated on

Updated on

By Ringy

Table of Contents

Table of Contents

We know what you want to hear.

Free insurance agency management software is just as good as a paid CRM, if not better… and you should just get it.

And you know what, maybe you should.

That's it for this blog then, see you around!

Hold up.

Clearly, there's more to the topic since we've prepared a good 3k words detailing:

- What insurance agency management software is

- Why do serious insurance agencies use CRM systems

- What you're really getting when you sign up for a free insurance CRM

- And whether free insurance agency software is the cheapest option at all

But that last one has got to be a joke, right?

We get how it sounds… but no, actually.

You'll understand in a minute.

So before you run off and grab the first candy you lay your eyes on, let us at least give you a tour of the candy shop.

What Is Insurance Agency Management Software

An insurance CRM, or agency management software, is a centralized, usually cloud-based solution that helps insurance agencies manage and grow their business.

Okay, and this time in English?

- It automates mundane tasks like data input, commission processing, manual dialing, etc.

- Organizes all data in the same system where everyone can access it

- Presents info in real-time and offers analysis

- Allows for effortless communication across the company and with clients

- Makes agents more efficient by taking over half of their regular to-do lists

Essentially, it makes your life easier while helping your company scale. Win-win.

If you're new to CRMs, here are some basic terms you'll need to have a grasp on so you don't get confused when we mention them later on:

|

Term |

What it means |

|

Cloud-based |

|

|

On-site |

|

|

Mobile accessibility |

|

|

Integrations |

|

|

Softphone/cloud VoIP |

|

How Does Insurance Agency Software Streamline Operations

Free insurance agency management software streamlines operations and frees up your time for what matters most – growing your business and building client relationships.

Think of it as your personal sidekick. These apps for insurance agents act as your command center. Here's how free insurance agency software can be your kryptonite to paperwork chaos:

- Track everything: From customer interactions to sales pipelines, these systems keep everything organized and accessible. No more digging through mountains of files or wondering where you left that important note.

- Automate the mundane: Say goodbye to tedious tasks like sending renewal notifications or scheduling appointments. Free insurance CRMs can handle these automatically, freeing up your time for more strategic work.

- Become a data detective: Unleash the power of reporting and analytics. These tools help you identify sales opportunities, track team performance, and make data-driven decisions that boost your bottom line.

- Empower your team: Give your agents the tools they need to succeed. Many free insurance agency management systems offer mobile access, collaboration features, and even training resources, making your team a well-oiled machine.

Types of Insurance Agency Software

Let's take a quick look at the types of Insurance agency software.

|

Free Insurance Agency Management Software |

Paid Insurance CRM Software |

|

|

Features |

Limited set of essential features:

|

More comprehensive features:

|

|

Maintenance & Updates |

Limited support, updates may be slow or infrequent |

Dedicated support team, regular updates and improvements |

|

Hosting |

Cloud-based or self-hosted options with limited support |

Secure, reliable cloud-based hosting with high uptime |

|

Scalability |

Limited scalability, may not accommodate growth |

Highly scalable to accommodate larger teams and data volumes |

|

Security & Compliance |

Basic security features, may not meet industry compliance standards |

Advanced security features and compliance certifications |

|

Customization |

Limited customization options |

High degree of customization to fit specific workflows and needs |

Pros and Cons of Free CRM Software for Insurance Agents vs. Paid

Choosing the right insurance agency management software (AMS) can dramatically impact your efficiency, communication, and profitability. While free options seem enticing, it's crucial to understand their limitations before making a decision.

Let's compare the pros and cons of both free and paid versions to help you decide.

Pros of free insurance AMS:

- Accessibility: Try before you buy! Free software lets you test the waters without upfront costs or trial limitations.

- Streamlined Operations: Cloud-based CRMs simplify workflows, replacing paper chaos with organized data and automated processes.

- Improved Communication: Manage client relationships, nurture leads, and automate reminders for a more professional and efficient approach.

- Analytics & Reporting: Gain insights into client data, agent performance, and sales trends to optimize your business.

- Scalability: Free AMS can handle basic needs, offering flexibility as your agency grows.

Cons of Free AMS:

- Limited Functionality: Free versions often lack advanced features like sophisticated calling, powerful automation, and advanced marketing tools.

- Space & Support Limitations: Free plans typically have limited storage and user slots, requiring upgrades as your agency expands.

Before we compare the two options, here's a quick overview of what you can enjoy with a paid subscription.

Paid AMS Advantages:

- Superior Functionality: Unlock powerful features that automate tasks, personalize interactions, and boost sales.

- Scalability: Accommodate growth with user additions, increased storage, and advanced capabilities.

- Enhanced Support: Rely on dedicated customer support for smooth implementation and ongoing assistance.

As promised, here's a quick comparison:

|

Feature |

Free AMS |

Paid AMS |

|

Accessibility |

Immediate access |

Trial periods or demos |

|

Functionality |

Basic features |

Advanced automation, marketing tools, and customization |

|

Communication |

Basic calling, texting |

Sophisticated calling features, personalized messaging, and campaign automation |

|

Analytics |

Basic reporting |

In-depth data analysis, sales funnel insights, and agent performance optimization |

|

Scalability |

Limited growth potential |

Accommodates expansion with additional users and storage |

|

Support |

Limited support channels |

Dedicated customer support for implementation and ongoing needs |

Benefits of Insurance CRM

Here, we look at the key advantages of using Insurance CRM, illustrating how it can transform the way insurance professionals engage with their clients and manage their businesses.

1. Better Data Management

Managing vast amounts of client data is a daunting task for insurance agents. However, with free insurance agency management software, the burden is significantly lightened. It allows you to centralize and organize client information seamlessly.

According to research, 94% of tech companies use CRM systems. So, there is probably a good reason to consider using one yourself.

From policy details to communication history, having a consolidated database enhances accuracy, reduces errors, and ensures that critical information is readily accessible.

2. A More Streamlined Sales Process

Forget tedious paperwork and chasing leads down rabbit holes. Free insurance agency CRMs help you:

- Automate repetitive tasks: Let the software handle the busy work while you focus on building relationships and closing deals.

- Manage your sales pipeline efficiently: Track leads, nurture prospects, and convert them into paying clients with organized workflows and visual pipelines.

- Send targeted email campaigns: Reach the right audience with personalized messages at the right time, boosting engagement and conversion rates.

Because of this, CRMs can shorten the sales cycle by 8-14%, which gives your reps more time to close more deals!

3. Improved Productivity and Efficiency for Your Team

Time is money, and free insurance agency software helps you spend yours wisely. With task automation, document management, and collaboration tools, your team can focus on what they do best – building relationships and closing deals.

Did you know that using a CRM system you can increase your productivity by 34%? That's right!

As a result, you'll witness a spike in productivity and, ultimately, a positive impact on your agency's bottom line.

4. Easier Identification of Cross-Sell and Upsell Opportunities

Free insurance agency management software isn't just about efficiency; it's about boosting your bottom line. With powerful data analysis tools, you can:

- Identify potential cross-sell and upsell opportunities: Analyze client data to recommend additional products or services that perfectly match their needs.

- Segment your client base: Tailor your marketing and outreach efforts to specific groups for maximum impact and conversion.

- Track campaign performance: Measure the success of your initiatives and refine your strategies for even better results.

5. Better Communication with Customers

Building trust with your clients is key, and free insurance CRM helps you do just that. Free CRM for insurance agents facilitates seamless communication by providing tools for email campaigns, automated follow-ups, and client segmentation. Stay connected with your clients, address their concerns promptly, and nurture long-lasting relationships that go beyond policy transactions.

And that's why everyone insists on using insurance software.

4 Considerations When Choosing an Insurance CRM

While "free" might sound enticing, remember that the devil is often in the details. And since you've read this far, the next sections are the most important, trust me. So, here's what you need to consider before choosing an insurance CRM.

Price vs. Features

Let's face it, "free" sounds sweet, but it's crucial to resist the allure of empty promises. While many free insurance CRM options exist, remember, "free" often comes with limitations. Some may restrict user numbers, storage space, or essential features like quoting modules or integrations.

Be mindful of these limitations and ensure the free plan aligns with your agency's current and future needs.

Prioritizing Ease of Use

Insurance jargon and complex interfaces can turn even the most enthusiastic techie into a grumpy caveman. Opt for free insurance agency software that's intuitive and user-friendly. Look for drag-and-drop functionality, clear navigation, and minimal learning curves.

Remember, your team's time is valuable, so prioritize software that empowers them to work smarter, not harder.

360-Degree Customer View

Your clients are the heart of your business. Choose software that fosters a holistic understanding of their needs and preferences. A robust free insurance crm should provide a 360-degree customer view, encompassing contact information, policy details, claims history, and communication logs.

This centralized data hub allows you to personalize interactions, anticipate needs, and ultimately, build stronger relationships.

Ensuring Scalability

Your agency is bound to evolve. Free software that hinders your growth is like buying a tricycle for a cross-country race. Choose a platform that scales seamlessly alongside your business. Look for solutions that offer flexible configurations, additional user options, and seamless integrations with other business tools. Remember, the software should grow with you, not hold you back.

Best Apps for Insurance Agents: Free & Paid

The right applications can streamline everyday tasks, simplify communication, and provide valuable insights into client needs. Now, let's look at the best apps available for insurance agents.

Free Insurance Agency Management Software Considerations

Here are some of the best free insurance agency management software out there:

Bitrix24

Bitrix24 is a robust app that works on desktops as well as Android and iOS. And it's a CRM that does everything:

- Sales tracking and reporting

- Automated sales funnel

- ROI calculation through Google Adwords

- Scheduling and organization, etc.

On top of that, Bitrix24 offers extensive support and even has a YouTube channel where you can get a closer look at their interface and features and also get sales tips.

We're man enough to admit that this CRM really gets it.

*Information as of October 2024.

HealthSherpa

Simple interface, very intuitive and basic.

This life and health insurance CRM was designed specifically for insurance brokers. HealthSherpa is easy to set up and has the vital AMS features like:

- Organizing clients and leads

- Client tracking shows which stage they're in

- Pre-filled renewal applications

And our favorite one, is the client-facing enrollment feature which lets people sign up through your website while you get the credit.

This app is generally uncomplicated, at least on the free plan.

The only downside is, HealthSherpa doesn't have mobile deployment.

*Information as of October 2024.

Connecteam

This software is primarily focused on your employees. Wherever they are.

You can't control what's going on outside your agency. But you can control:

- What your employees are doing and when

- The processes and objectives behind tasks

- Schedules, organization, and employee training

- The amount of paperwork your teams will or will not have to manually keep track of

Essentially, you can make everyone's job much easier and get way more done for your clients.

Or you can, you know, not do that.

Connecteam offers decent automation, advanced reporting, and a dedicated support team for anything else you might need.

*Information as of October 2024.

Top 3 Paid Insurance CRMs

AgencyBloc

AgencyBloc is a popular industry-specific CRM.

It has a robust range and it's easy to start with.

And, we don't know if you've noticed this about CRMs, but you often get to pick only one of those over the other.

But if you're considering AgencyBloc, here are a couple of things to look forward to:

- 360-degree view of your business

- Customizable reporting

- Excellent lead management

- You can set up, schedule, and automatize virtually anything

Pricing: Customized pricing as of October 2024

Ringy

There's one very important reason why we're even mentioning Ringy in this list when it's not an AMS per se.

And it's not because it's our product.

It's automation.

Remember drip campaigns, automated messaging, scheduling, and all the other things we listed under automation?

Ringy actually does them all.

This means less time pressing buttons and repeating menial tasks, and more time dedicated to your clients.

It's basically a sales assistant. Here are some reasons why insurance agencies use Ringy:

- It's mobile-friendly, so you're always available

- Major time saver due to all the legwork it does for you

- Intuitive dashboard with all the important data

- Offers unparalleled customer support

Pricing: $109/month (as of October 2024)

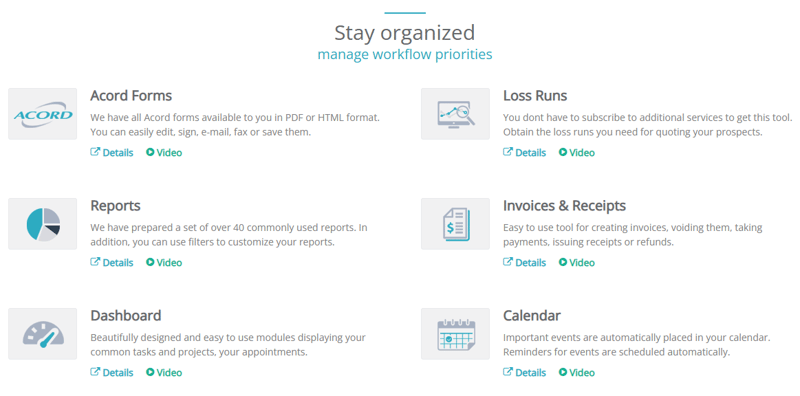

NowCerts

Agency-focused and built on the premise of self-serving clients.

NowCerts takes the load off your back by empowering your clients to carry their own weight which becomes an obvious asset the more clients you have.

Think of the individual accounts, forms, payments, renewals, reminders…

And then feel free to forget all about it if you give NowCerts a shot.

Pricing: Starting at $99/month (as of October 2024)

Conclusion: Free or Paid, Insurance Agencies Need CRM

There's a lot to consider when it comes to picking out a CRM for your insurance agency.

Yes, the expenses are a big factor.

But no matter how much your CRM costs, you'll need some effort to successfully onboard your agency.

More importantly, you need to make sure that once that's done with, you're left with all the tools you need to take care of your clients and boost your performance.

And now that you know:

- What your options really are

- How free and paid CRMs compare to each other

- Which features should be insurance agency non-negotiables

It's about time you got yours.

But we understand that just reading words about it isn't enough to imagine what a CRM would actually look like, not to mention your day-to-day life with it.

Which is why we have a little trailer.

So, if you're still on the fence about the next step, simply request a demo with Ringy. No strings attached.

Skyrocket your sales with the CRM that does it all.

Calling? Check. SMS? Check. Automation and AI? Check. Effortlessly keep in touch with your customers and boost your revenue without limits.

Take your sales to new heights with Ringy.

Sales in a slump? Ringy gives you the tools and flexibility you need to capture leads, engage with them, and turn them into customers.

Subscribe to Our Blog

Enter your email to get the latest updates sent straight to your inbox!

Categories

Related Articles