Table of Contents

Table of Contents

A single day in an insurance agent's life is littered with various tasks to complete and meetings to attend. From scheduling appointments, contacting prospective clients, and closing deals, insurance agents are busy and engaged with work throughout the day.

If work processes are not managed consistently in a streamlined manner, it's possible that agents could miss out on essential tasks. To negate such scenarios, CRM for insurance agents streamlines and automates workflows to free up the representatives' time.

CRM insurance for agents allows teams to manage policies, clients, and other vital data from a centralized location.

This article covers why CRM for insurance agents is recommended, the benefits, the features, a list of the best insurance CRMs, and why opting for a free CRM for insurance brokers are inadequate.

Let's hop in!

What is CRM Software for Insurance Agents

Innovative solutions, such as insurance CRM software, address the particular requirements of insurance agents and businesses. Insurance broker CRM platforms automate assignments to the correct team or person, manage multiple policies from a single location, and organize business operations.

Companies can find increased efficiency in their processes and workflows with efficient CRM software for insurance agents. CRM insurance agent software allows sales representatives to offer a customer-centric experience by continuously providing teams with information about client interactions and their needs.

Investing in an insurance broker CRM software helps organizations win in various business areas, including team management, sales performance, and productivity.

Why a CRM for Insurance Company is Essential

A CRM software is essential for insurance companies of all sizes. It helps insurance agents to manage their leads, customers, and policies more efficiently and effectively. CRM software can also help insurance companies to improve their customer service, increase sales, and grow their business.

Here's more information about why a CRM for an insurance company is important.

Have a Centralized Source of Truth for Your Data

Managing client data is the lifeline of any insurance agency, and a CRM for insurance agents is the guardian of this invaluable information. Picture it as a digital vault where all client interactions, policy details, and communication histories converge.

This centralized source of truth eliminates data silos, ensuring that every team member has real-time access to the most updated and accurate information. It enhances collaboration and minimizes the risk of errors, promoting a smoother workflow.

Stay Competitive

In the competitive landscape of insurance, being a step ahead is not just an advantage but a necessity. A robust insurance CRM system empowers agents with insights, helping them understand client needs better and anticipate market trends.

By efficiently managing leads, automating routine tasks, and providing a 360-degree view of client interactions, CRM software ensures your team stays competitive and responsive in an industry where timing can be everything.

Build Customer Trust and Confidence

Trust is the cornerstone of successful client relationships in the insurance business. A CRM for an insurance company helps build and maintain this trust by fostering personalized and timely communication. Imagine a tool that reminds you of upcoming policy renewals and prompts you to reach out to a client on their birthday or anniversary.

Such thoughtful gestures go a long way in showing clients they are not just policy numbers but valued individuals. This personalized touch, facilitated by CRM, enhances customer confidence and loyalty.

Features and Benefits of CRM Insurance Software

Banking, financial services, and insurance account for over 20% of the worldwide CRM software market. The evolution of digitization has forced insurance companies to stray from conventional client service methods to customer relationship management tools and approaches.

Additionally, it takes more than integrating a CRM for insurance agent software to witness business growth and improve agent efficiency. Instead, ensuring the insurance agent CRM platform is compatible with your company's requirements is critical.

With that in mind, let's examine the features and benefits of utilizing CRM software for an insurance company.

Features of CRM insurance agents:

- Workflow Management: Automate tasks and processes, such as quote generation, policy renewal, and claims processing, to streamline your operations and save time.

- Seamless Prospect Capturing: Capture leads from all sources, including your website, social media, and email marketing campaigns, and add them to your CRM system automatically.

- Automatic Lead Distribution: Assign leads to the right agents based on their skills and experience, or round-robin, to ensure that all leads are followed up on promptly.

- Lead Ranking: Prioritize leads based on their likelihood to convert so that your agents can focus on the most qualified leads first.

- Sales Enable for Field Agents: Give your field agents access to the information they need on the go, such as customer data, product information, and quotes, to close deals faster.

Benefits of CRM insurance agents:

- Improved Customer Experience: Provide your customers with a more personalized and efficient experience by having all of their information in one place and being able to track their interactions with your company across all channels.

- Customer Data Management: Centralize your customer data in one place and make it easily accessible to all of your team members so that you can better understand your customers and their needs.

- Secured Client Data: Keep your customer data safe and secure with robust security features like encryption and role-based access control.

- Insights into Reports and Data Analytics: Gain valuable insights into your sales performance, customer behavior, and other key metrics with comprehensive reporting and data analytics tools.

Insurance Brokers CRM Selection Considerations

Identifying an insurance broker CRM platform for your agency is a big decision.

The CRM software chosen significantly affects the productivity of the insurance agent sales team. Selecting a CRM insurance agent software that meets the specific requirements of your business and provides all the key features it needs automatically increases efficiency.

When selecting the best CRM software for insurance agents, it's vital to consider the factors discussed below.

- Understanding Your Business's Unique Requirements: Consider factors such as the scale of your operations, the complexity of your offerings (life insurance, general insurance, etc.), and the unique workflows involved in your daily operations. A comprehensive understanding of your business requirements ensures that the chosen CRM aligns seamlessly with your operations, enhancing rather than complicating your processes.

- Intuitive User Interface: A user-friendly interface is paramount for a successful CRM implementation. Insurance agents are often on the move, meeting clients or working remotely. Therefore, the CRM system should have an intuitive design that enables easy navigation and quick access to essential information. Incorporating a CRM that aligns with your team's workflow ensures that agents spend more time engaging with clients and less time navigating complex software.

- Mobile Friendly: Mobility is a crucial aspect of the insurance industry. A mobile-friendly CRM system enables agents to access vital client information, update records, and manage tasks on the go. This flexibility enhances productivity and ensures that opportunities are not missed, especially when client interactions happen outside the office environment.

3 Best Insurance Agency CRM

As an insurance agent, managing customer relations is vital to success. Whether specializing in property, life, health, or any other form of insurance, keeping track of client's preferences and requirements is vital to providing them with the best service possible.

However, with so many different CRM insurance agent software available, selecting the most suitable one for your agency can be arduous.

Let's look at the top insurance agency CRM software solutions on the market.

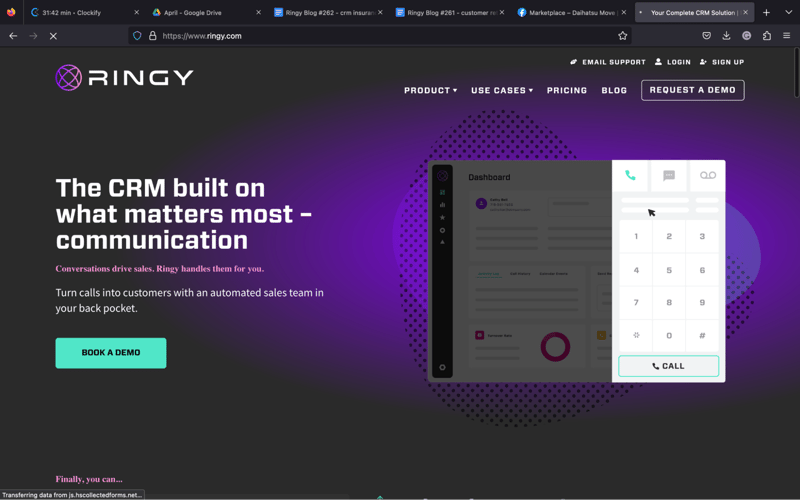

Ringy

This CRM insurance agent software was built on what matters most - communications. Ringy is the ultimate sales CRM for insurance agencies, offering all the tools required to sell smarter. It is fast, intuitive, and affordable while being a centralized database for all client information and interaction data.

Ringy's cutting-edge technology allows agents to automate and streamline their CRM workflow, make data-driven decisions, and reach prospects more efficiently.

The table below highlights the core features of Ringy's insurance agent CRM solution:

|

Feature |

Description |

|

Customer management |

Store and manage customer information, such as names, contact details, policies, and claims data. |

|

Lead management |

Track potential customers and their interactions with your business. |

|

Sales pipeline management |

Visualize your sales process, track deals, and monitor progress toward closing transactions. |

|

Task management |

Create and assign tasks to team members and set deadlines. |

|

Calendar integration |

Sync your Ringy calendar with Google Calendar, Outlook, or Apple Calendar. |

|

Email integration |

Send and receive emails directly within Ringy and track email interactions with customers. |

|

Policy management |

Track and manage policy information, including coverage details, premiums, and renewals. |

|

Claims management |

Monitor claims activity, track claims status, and manage claims processes. |

|

Reporting and analytics |

Generate reports and analyze data on sales performance, customer engagement, claims, and more. |

|

Customization |

Tailor the software to your business needs by creating custom fields, workflows, and automation. |

|

Mobile app |

Access Ringy on the go with the mobile app, available for iOS and Android devices. |

|

Collaboration |

Collaborate with team members on deals, share information, and work together on tasks. |

|

Integrations |

Connect Ringy with other business tools, such as Zapier, Slack, and Mailchimp. |

With Ringy's intuitive interface, sales teams can benefit from multiple communication channels, built-in AI, and automation without a steep learning curve or breaking the bank. From lead nurturing messages to local caller ID, Ringy allows your team to concentrate on high-quality sales calls that win customers.

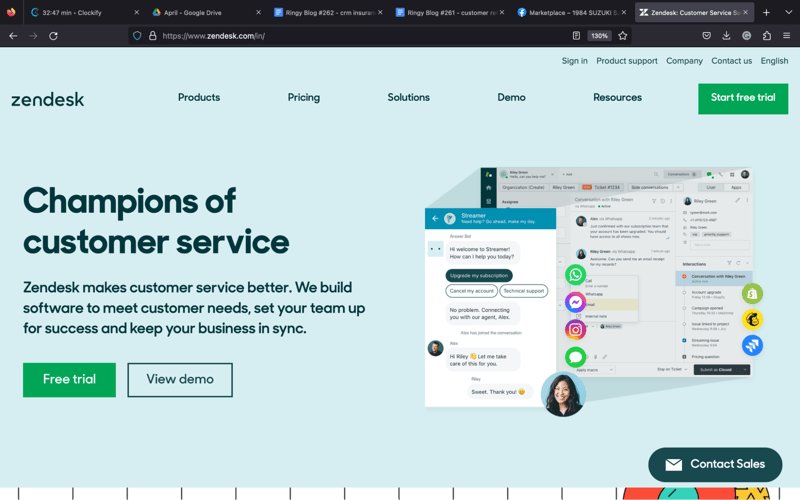

Zendesk

This CRM software for insurance brokers includes communication tools, such as call center divergence, social media chats, emails, and text messaging. Insurance agents making phone calls receive script suggestions to make their job easier until they find their sales voice.

Zendesk includes email marketing automation tools that aid in the lead-generation process and nurture clients throughout the sales funnel. Insurance companies can track individual sales, personal performance, and business goals with Zendesk's easy-to-use dashboard.

The software offers three key features to help insurance businesses maximize their ROI:

- Customizable workflows - Zendesk can be personalized to suit an organization's needs and automate rudimentary tasks, such as follow-up emails and ticket assignments.

- Ticket management - Create, track, and manage client support tickets from Zendesk's centralized user interface.

- Self-service options - AI-power chatbots, community forums, and knowledge base wizards help your customers find the answers they are searching for.

- Security and compliance - Security and compliance are a top priority for Zendesk. The software includes features such as GDPR compliance, data encryptions, and two-factor authentication.

Zendesk is an excellent customer service CRM for small to medium enterprises. The software is loaded with features, affordable, and easy to use. Zendesk can be the game changer in the customer service operations department you've been looking for.

NetSuite CRM

With a dedicated financial service CRM tool kit, NetSuite CRM was developed with insurance agencies in mind. It is part of the large Oracle business software suite that lets you do budgeting, revenue management, and forecasting.

NetSuite CRM sales tools allow users to set auto reminders, follow up emails, and manage leads in the sales pipeline.

The table below outlines some key advantages of using NetSuite CRM for insurance businesses:

|

Benefit |

Description |

|

Complete view of customer data |

NetSuite CRM provides a centralized customer data database, including contact information, policy details, and claims history. It gives insurance agencies a 360-degree view of their customers to understand their needs and preferences better. |

|

Streamlined lead management |

Insurance firms may handle leads more effectively thanks to NetSuite CRM's automated lead distribution, tracking, and capturing systems. In doing so, agencies can reply to leads more rapidly and improve their chances of turning them into clients. |

|

Automated policy renewal reminders |

NetSuite CRM may automatically send policy renewal reminders to clients, helping insurance businesses decrease the risk of policy lapses and missed renewals while assisting companies in enhancing revenue and client retention. |

|

Customizable dashboards and reports |

Customizable dashboards and reports are available in NetSuite CRM and give immediate insights into important parameters like sales success, client retention, and claim processing timeframes. Insurance companies may use this information to make data-driven choices and pinpoint development opportunities. |

|

Seamless integration with other systems |

Insurance firms may streamline operations and boost efficiency by integrating NetSuite CRM with other platforms, such as underwriting and claims processing software. |

NetSuite CRM is an effective customer relationship management platform that can work for organizations of all sizes. The software is highly scalable and customizable, with fantastic features that streamline work processes while boosting productivity.

CRM Insurance Agents - Final Thoughts

Modern sales executives and insurance agents are peas in a pod. With insurance agent CRM platforms, users get the best software to serve clients while focusing on building lasting customer relationships.

An insurance agent CRM gives reps a dynamic view of all leads in progress and a detailed picture of each customer. Cut down on client churn rates and dropped leads with the best CRM for insurance agencies - Ringy.

If you want to dip your toes in CRM, our software helps get the job done quickly, cheaply, and effectively.

Request a demo to find out what all the fuss is about!

Skyrocket your sales with the CRM that does it all.

Calling? Check. SMS? Check. Automation and AI? Check. Effortlessly keep in touch with your customers and boost your revenue without limits.

Take your sales to new heights with Ringy.

Sales in a slump? Ringy gives you the tools and flexibility you need to capture leads, engage with them, and turn them into customers.

Subscribe to Our Blog

Enter your email to get the latest updates sent straight to your inbox!

Categories

Related Articles