AI Insurance: Boosting Sales in the Insurance Industry

Updated on

Updated on

By Robins Dorvil

By Robins Dorvil

Robins Dorvil

With over 7 years of experience in the insurance industry, 4+ years as an Account Executive at Ringy CRM, and 17 years as a Creative Real Estate Inves...

learn more

Robins Dorvil

With over 7 years of experience in the insurance industry, 4+ years as an Account Executive at Ringy CRM, and 17 years as a Creative Real Estate Inves...

Table of Contents

Table of Contents

Artificial intelligence is a hit-and-miss for some business owners.

With all the technical jargon, prompts, and inconsistent outputs, it feels like you'll never know what this technology might spit out.

However, did you know that if you harness the power of AI correctly, you can boost leads for your insurance agency and make your agents' lives easier?

Improved claim processing, underwriting, and fraud detection are a few of the fundamental benefits of implementing insurance AI technology into your business. Imagine having a tireless, hyper-smart assistant who helps boost your sales, predict customer needs, and streamline your operations.

Goals like this are possible with AI insurance.

Let's dive in!

What Is AI Insurance?

Technology is changing the world. And in recent years, artificial intelligence has been at the forefront of this movement.

For marketers in the know, handling routine tasks, analyzing data, predicting customer expectations, and personalizing outreach have become routine. Not only does AI for insurance streamline workflows, cut costs, and allow for data-driven decisions, but it also frees up your time to focus on what really matters—your customers and closing deals with them.

Let's look at the key components of AI in the insurance industry that'll improve your understanding of it:

- Data Analytics: Picture AI as your personal detective, sifting through mountains of data to uncover hidden insights, trends, and patterns. These discoveries empower you to make informed decisions with confidence.

- Customer Service Automation: Imagine your customers receiving instant, accurate responses to inquiries, claims, and policy questions. AI-powered chatbots and virtual assistants make this possible, boosting customer satisfaction and loyalty:

- Risk Assessment: With AI, you can predict risks with uncanny precision. By analyzing historical and real-time data, AI helps you make better underwriting decisions, protecting both your clients and your business.

- Fraud Detection: Think of AI as your vigilant guardian, constantly looking for suspicious activities and potential fraud. It helps you safeguard your business and your clients from financial harm.

- Personalization: AI knows your customers almost as well as you do. It tailors insurance products and services to meet their unique needs and preferences, creating a more personalized and meaningful customer experience.

- Predictive Maintenance: In property and casualty insurance, AI acts as your foresight, predicting when maintenance is needed. This proactive approach reduces costly claims and enhances your risk management strategy.

With the strategies, tools, advantages, and use cases for AI and insurance, as an agent, you'll be silly not to use this technology to your benefit.

AI Life Insurance: Use Cases and Benefits

With the revolutionization brought about by AI insurance, enhancing risk management, personalizing your client policies, and determining their lifetime value (LTV) becomes a rudimentary task rather than something you or your agents loathe.

AI brings remarkable benefits to both the insurance and SaaS industries (not to mention remote sales) that drive data-driven decisions.

Here are the typical applications of AI life insurance:

|

Aspect |

Description |

|

Insurance Analytics and AI |

The integration of artificial intelligence into insurance analytics is revolutionizing the industry. AI enables insurers to analyze data more efficiently, predict outcomes more accurately, and make well-informed decisions, ultimately enhancing the service you receive. |

|

Role of AI in Insurance Analytics |

Advanced algorithms and machine learning play a crucial role in insurance analytics. They help insurers detect patterns, identify trends, and anticipate your needs with remarkable accuracy. |

|

Data Collection and Processing |

Collecting and processing large volumes of data from multiple sources becomes seamless with AI. This ensures that all relevant information about you is considered, allowing for the creation of tailored and effective insurance solutions. |

|

Predictive Modeling and Risk Assessment |

Analyzing historical data to predict future outcomes is akin to having a crystal ball. It allows insurers to assess risks with precision, ensuring that you receive the protection you need. |

|

Benefits of AI-Driven Analytics |

The advantages of AI-driven analytics are manifold, enhancing your overall experience. From faster claim processing to more accurate policy pricing, you benefit from improved service and greater efficiency. |

|

Improved Decision-Making |

Decision-making becomes quicker and more accurate, meaning your claims are processed swiftly, your policies are tailored to your specific needs, and your overall experience is significantly enhanced. |

Enhanced Risk Management |

Identifying and mitigating potential threats before they become significant issues enhances risk management. This ensures that you are always well-protected and provides you with peace of mind. |

The proliferation of AI insurance analytics and its impact on the industry doesn't only focus on improving processes but also transforms both the user and agent experience.

AI Insurance Customer Service

With the advent of AI insurance services, new standards are being set in the industry. The significant transformation of AI insurance and customer service tool integrations is a change that should not be taken lightly.

Here are the most prominent ways AI insurance is helping to improve customer satisfaction.

AI-Powered Customer Service Tools

By leveraging artificial intelligence, your agency can now offer a seamless, personalized experience that meets your client's changing needs. AI insurance tools can assist with a plethora of tasks, from answering simple queries to managing complex claims.

Let's look at a few key features a little closer.

|

AI-Powered Customer Service Tools |

Chatbots and Virtual Assistants |

Natural Language Processing (NLP) for Customer Interactions |

|

Automates routine tasks such as claim processing and customer information updates |

Provides instant responses to customer inquiries, reducing wait times |

Enhances communication by understanding and interpreting human language |

|

Analyzes vast amounts of data for better customer insights |

Handles complex queries with context and intent understanding |

Analyzes sentiment in customer messages to prioritize issues |

|

Integrates with existing insurance CRM and ERP systems for efficient workflows |

Continuously learns and improves through machine learning algorithms |

Supports multiple languages for global customer service |

Insurance chatbots and virtual assistants are leading the change in customer service, and rightfully so. For example, if your client is seeking information about their policy, they can engage with a chatbot to obtain that information rather than waiting on hold for a human agent.

NLP works hand in hand with chatbots. This technology helps AI grasp customer queries to ensure a more accurate and relevant response. For instance, if the customer asks about their policy's coverage for a specific type of incident, AI insurance software can understand the content and provide a detailed response based on the policy details.

Advantages of AI in Customer Service

Integrating AI insurance technology into your customer support is the best way to revolutionize your business and increase customer loyalty and retention.

Who wouldn't want to provide a more efficient, effective, and personalized service?

Below, we explore the key advantages of AI in customer service. Each of these benefits contributes to a more seamless and satisfactory client experience.

|

Advantages of AI in Customer Service |

Description |

|

24/7 Availability |

AI-powered tools ensure that customers have access to support at any time, day or night. This round-the-clock availability provides convenience and reliability, allowing customers to resolve issues or get information whenever they need it, without being restricted to business hours. This is especially crucial in emergency situations. |

|

Faster Response Times |

AI can handle customer inquiries promptly, significantly reducing wait times. Automated systems can quickly address routine questions and issues, freeing up human agents to focus on more complex problems. This leads to a more efficient customer service operation and ensures that customers receive timely assistance, enhancing their overall satisfaction. |

|

Personalized Customer Support |

AI analyzes customer data to provide tailored support, meeting the unique needs of each client. By leveraging data analytics and machine learning, AI systems can recognize patterns in customer behavior and preferences, offering personalized recommendations and solutions. This level of customization helps build stronger customer relationships and loyalty. |

The advantages of AI in customer service are undeniable. With 24/7 availability, faster response times, and personalized support, AI tools are changing how we satisfy our customers while boosting operational efficiency.

Sales Strategies Using AI in Insurance

As we can see, artificial intelligence is reshaping not only the insurance industry but also all customer-related sectors.

But what's the use of AI insurance if you don't have sales strategies to implement it?

First, let's examine how AI is transforming insurance sales and then explore a few examples of AI sales tools and platforms that can make your life easier.

How AI Is Transforming Insurance Sales

Artificial intelligence is shaking up the world of insurance. It's giving insurance companies a powerful new tool to better understand their customers. By crunching massive amounts of data, AI is helping insurers spot patterns in customer behavior, figure out what people want, and identify trends in the market.

This data magic is leading to some pretty significant changes:

- Personalized Service: AI is helping insurers tailor their offerings to individual customers. Imagine getting insurance recommendations that perfectly match your lifestyle and needs.

- Smarter Risk Assessment: AI can analyze risks in ways humans can never do, leading to fairer and more accurate insurance pricing.

- Supercharged Efficiency: From automating paperwork to optimizing sales processes, AI streamlines operations and saves time.

All this means insurers can offer a better experience, attract new customers, and stay ahead of the competition. It's an exciting time for the industry, and AI is at the heart of it all.

Enhanced Customer Understanding

Understanding your clients is like having a superpower. It's the difference between pitching a policy and building a relationship. AI is giving us an X-ray vision of our customers' lives. By crunching those numbers, we can pinpoint exactly what they need and want—no more guessing games.

Imagine offering a policy that feels like it was tailor-made for each client. That's the power of AI. It's not just about selling insurance; it's about providing solutions that truly matter.

Predictive Analytics

Predictive analytics is like having a crystal ball for your business. It's not magic; it's smart data. By analyzing what's happened, we can make educated guesses about what's coming next. This isn't just about predicting the weather (though that would be cool); it's about seeing trends in customer behavior, spotting potential risks before they blow up, and figuring out where the golden opportunities are hiding.

Imagine being able to anticipate when a customer might need to upgrade their policy or when a certain area is about to see a spike in claims. With predictive analytics, you can be one step ahead. It's like having a personal assistant who whispers, "Hey, check this out," just before something big happens. This kind of foresight lets us tailor our offerings, adjust our pricing, and protect our bottom line.

So, let's stop reacting to surprises and start shaping the future. Predictive analytics is our ticket to staying ahead of the game.

Automation of Routine Tasks

Automating routine tasks through AI offers transformative benefits for insurance sales operations. AI systems can efficiently manage repetitive activities such as:

- Data entry

- Policy renewals

- Initial customer inquiries

This automation reduces the administrative burden on insurance agents, allowing them to focus on more strategic and value-added activities. By streamlining these processes, AI insurance technology enhances overall productivity and accuracy, ensuring that your agents can devote more time to building relationships and closing sales.

Improved Risk Assessment

Risk assessment is the backbone of our business, right?

It's how we decide who to insure and what to charge. With AI, we're getting a supercharged microscope into our customers' lives. We're talking about digging deeper than ever before.

AI can spot patterns and connections that would take us humans forever. It's like having a team of expert detectives working around the clock. This means we can price policies more accurately, tailor coverage to the exact needs of our clients, and even predict potential problems before they happen.

The bottom line?

We're offering fairer deals to our customers while protecting our business. It's a win-win.

Lead Generation and Qualification

You're in the business of turning strangers into clients. Let's face it, finding quality leads is like searching for a needle in a haystack—but with AI, we've got a high-tech metal detector.

Imagine spending less time chasing down dead ends and more time closing deals. That's the power of AI-driven lead generation. It's like having a team of expert prospectors working for you, separating the gold from the gravel.

With AI on your side, you can focus on what you do best: building relationships and closing sales.

Let's turn those leads into loyal customers.

Here are a few other ways AI insurance software assists with lead generation and qualification.

Identifying High-Potential Leads

Think of your leads as a garden. You want to nurture the ones with the most potential, right? AI is like a super-smart gardener, analyzing every plant (or lead) to figure out which ones are most likely to bloom into loyal customers.

It's not just about numbers and data; it's about understanding people. AI digs deep into customer behavior, lifestyle, and even their digital footprint to find the perfect matches for your products. By focusing on these high-potential leads, you’re not just increasing your sales; you’re building a customer base that's genuinely excited about what you offer.

Personalized Outreach

Gone are the days of generic sales pitches. Today's customers crave connection and relevance. AI is your secret weapon for delivering just that. By understanding your customers on a deeper level, you can craft messages that feel like they were written just for them. It's like having a personal assistant who knows exactly what to say to make a great first impression.

Imagine sending an offer that perfectly aligns with someone's needs, right when they're ready to buy. That's the power of personalized outreach. It's not just about selling a policy; it's about building trust and rapport.

With AI as your guide, you can turn casual browsers into loyal customers.

Real-Time Lead Scoring

AI insurance technology is like having a real-time radar that constantly tracks your leads, updating their potential value every second. That's what this software can do to lead scoring. It's like having a genie who predicts which leads are about to blossom into customers.

AI insurance software is constantly analyzing what your leads are doing:

- Checking website pages: Are they exploring your products or just window shopping?

- Opening emails: Are they engaged with your content?

- Clicking on links: Are they showing interest in specific offers?

Based on this real-time data, your leads are assigned a score that reflects their hotness.

This means you can:

- Prioritize your time: Focus on the leads most likely to buy.

- Personalize your approach: Tailor your pitch to each lead's interests.

- Close deals faster: Seize opportunities as soon as they arise.

AI insurance platforms are like a personal assistant who tells you which leads to pursue and when to pounce.

Sales Automation and CRM Integration

AI is transforming how we sell insurance. Automating routine tasks and providing powerful insights is changing the game for insurance companies.

AI is changing the way we work. It automates routine tasks, provides powerful insights, and transforms how we interact with customers.

In the following sections, we'll delve into how AI can revolutionize your sales process:

- Streamlining Sales Processes: Increase efficiency and reduce manual work.

- Enhanced Customer Relationship Management (CRM): Build stronger, more lasting customer relationships.

- Predictive Sales Analytics: Make data-driven decisions to boost sales.

Let's explore how AI can help you achieve your sales goals.

Streamlining Sales Processes

Focus on what matters most: your clients.

AI-driven sales automation can free you from the burden of paperwork. These tools handle the time-consuming tasks that often get in the way of building relationships. From sorting through leads to processing policies, AI ensures accuracy and speed.

This means less manual work, fewer errors, and faster results. Your policies get processed quicker, clients receive faster responses, and you have more time to focus on what truly drives success: connecting with people and closing deals.

Streamlining your sales process will boost productivity and generate more revenue. It's time to harness the power of AI to elevate your sales game.

Enhanced Customer Relationship Management (CRM)

Integrating AI with your CRM system is like adding a seasoned sales veteran to your team. AI delves deep into customer data, uncovering patterns and preferences that can transform your approach.

With AI, you gain a powerful tool for predicting customer behavior, automating follow-ups, and tailoring your communications. This means more strategic interactions, stronger relationships, and increased customer retention.

By harnessing the power of AI, you're positioning your business for long-term success.

Predictive Sales Analytics

Imagine having a tool that could anticipate market shifts, identify promising leads, and even predict which deals are most likely to close. That's the power of AI-driven predictive analytics. By analyzing mountains of data, these intelligent systems uncover hidden patterns and trends that can revolutionize your sales strategy.

No more guessing about the future.

Predictive analytics provides actionable insights that help you focus your efforts on the most promising opportunities. You'll be able to anticipate customer needs, optimize your sales approach, and make data-driven decisions that drive results. It's like having a seasoned sales expert working alongside you, providing guidance every step of the way.

Examples of AI-Driven Sales Tools and Platforms

AI-driven sales tools and platforms are transforming the insurance industry by providing advanced features for managing sales processes and customer interactions.

These platforms leverage AI technology to support various aspects of sales, from lead generation to customer relationship management, enabling insurance companies to achieve their sales objectives more effectively.

Let's look at some of our favorite AI-driven sales tools and platforms.

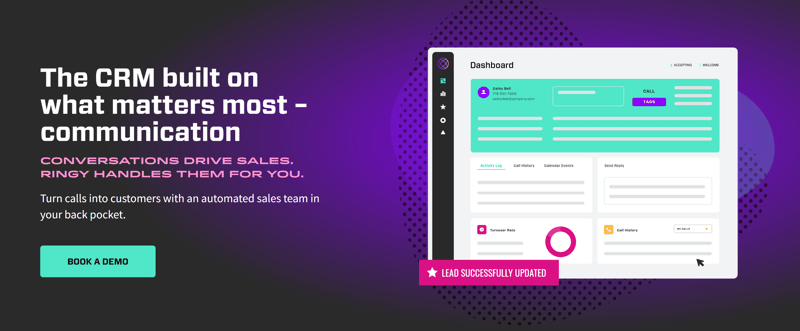

Ringy

Ringy is a sales software CRM with AI-driven sales tools designed to optimize various aspects of the sales process. With features such as VoIP calling, sales pipeline management, and customer behavior insights, Ringy supports insurance agents in managing their leads and sales efforts.

Its marketing automation capabilities streamline tasks such as lead nurturing and follow-up, enhancing overall productivity.

Salesforce Einstein

Salesforce Einstein is an advanced AI platform that integrates with Salesforce CRM to provide powerful analytics and automation features. Einstein uses machine learning to analyze customer data, offering predictive insights and recommendations that enhance sales strategies.

Key capabilities include lead scoring, opportunity insights, and automated follow-ups.

Salesforce Einstein’s AI-driven features help insurance agents optimize their sales efforts and achieve better results by leveraging data-driven insights.

HubSpot AI

HubSpot AI integrates with the HubSpot CRM platform to offer a range of AI-driven features that enhance sales performance.

AI capabilities include automation of routine tasks, predictive analytics, content generation, and personalized recommendations.

HubSpot AI helps insurance agents streamline their workflows, prioritize leads, and tailor their communications to individual customers. By leveraging HubSpot AI’s features, insurance companies can improve their sales processes and drive better outcomes.

AI Insurance—Final Thoughts

AI is reshaping the insurance sales landscape by offering innovative solutions for enhancing customer understanding, optimizing lead generation and qualification, and automating sales processes.

As insurance and AI technology continue to evolve, their impact on insurance sales will only grow, offering new opportunities for innovation and success.

And what better way to get started than by giving our solution, Ringy, a test run?

With dynamic features to help you through every part of the sales process and handy AI tools that help boost your productivity, Ringy is an all-in-one solution for managing your insurance business.

Don't believe us?

Request a demo to learn how we're changing the game, one sale at a time.

Skyrocket your sales with the CRM that does it all.

Calling? Check. SMS? Check. Automation and AI? Check. Effortlessly keep in touch with your customers and boost your revenue without limits.

Take your sales to new heights with Ringy.

Sales in a slump? Ringy gives you the tools and flexibility you need to capture leads, engage with them, and turn them into customers.

Subscribe to Our Blog

Enter your email to get the latest updates sent straight to your inbox!

Categories

Related Articles